Rental Property Flooring Depreciation

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Rental property flooring depreciation. It is the mechanism for recovering your cost in an income producing property and must be taken over the expected life of the property. Like appliance depreciation carpets are normally depreciated over 5 years. Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property. For property used for both business and personal purposes you can only take depreciation on the portion of the flooring used in the business side of the property.

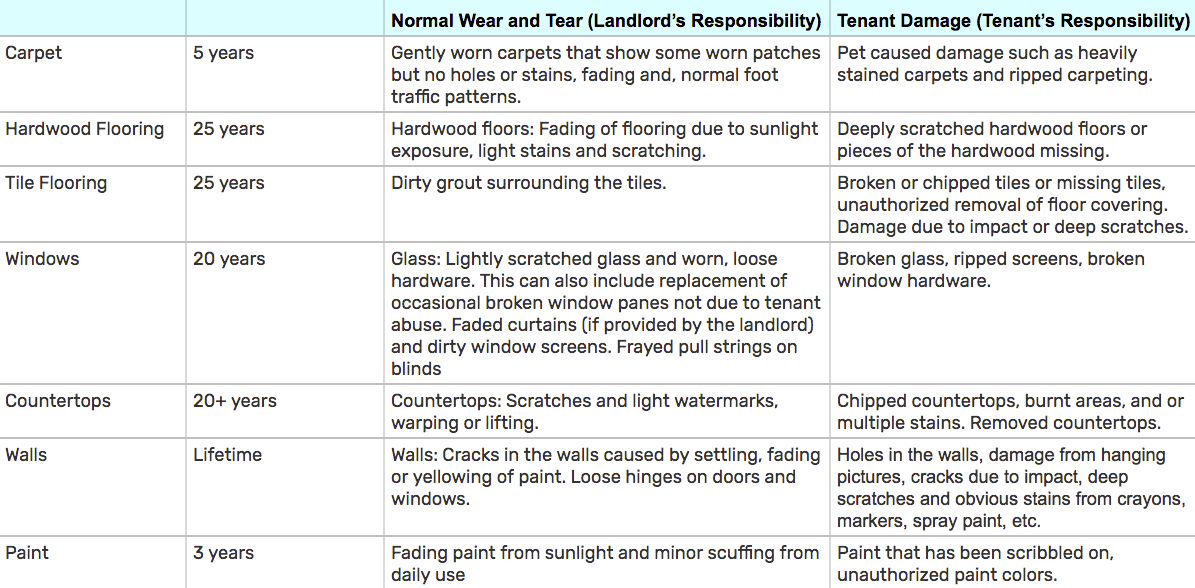

As with the restoration costs discussed above these costs are in the same class of property as the residential rental property to which the furnace is attached. This applies however only to carpets that are tacked down. 10 years 8 years. The landlord should properly charge only 200 for the two years worth of life use that would have remained if the tenant had not damaged the carpet.

See placed in service under when does depreciation begin and end in chapter 2. 10 years depreciation charge 1 000 10. For example if you own a duplex and live in one half you can write off only the new flooring in the rental unit but not the flooring in your own personal unit. Depreciation is a capital expense.

You can begin to depreciate rental property when it is ready and available for rent. Carpet life years remaining. Depreciation can be a valuable tool if you invest in rental properties because it allows you to spread out the cost of buying the property over decades thereby reducing each year s tax bill. Expected life of carpet.

As such the irs requires you to depreciate them over a 27 5 year. Most flooring is considered to be permanently affixed. The first thing that real estate owners need to know about bonus depreciation is that it cannot be used on rental properties themselves. Since these floors are considered to be a part of your rental property they have the same useful life as your rental property.

These types of flooring include hardwood tile vinyl and glued down carpet. Since these floors are considered to be a part of your rental property they have the same useful life as your rental property. I could see that for a rental property because in general a renter doesn t take care of the property like they would if they owned it. Bonus depreciation for rental property owners.